Investment Updates

Optimizing A Retirement Portfolio For Taxation

Published Friday, August 14, 2015 at: 7:00 AM EDT

Locating investments in the right type of account can make a big difference in your retirement savings and lifestyle.

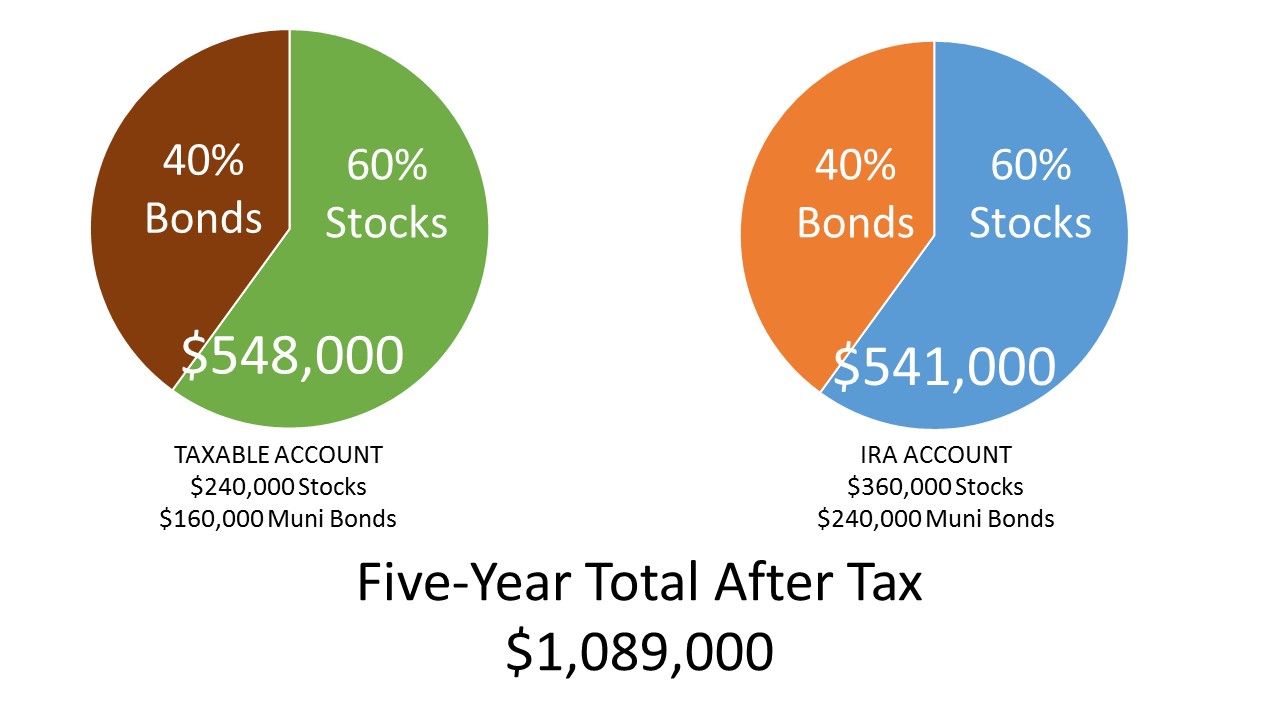

Here's the story, told through an example of a hypothetical couple — Jodi and Mark — with a $1 million in savings. Their tax-advantaged IRA accounts hold $360,000 in stocks and stock mutual funds, plus another $240,000 in taxable bonds. Jodi and Mark's taxable account holds $400,000, with a 60% in stocks returning 10% annually in capital gains and 40% in muni bonds yielding 3.6% of income.

To keep it real, let's make these very reasonable assumptions:

- bonds yield 6% of income annually

- stocks return a 10% capital gain annually

- residents of a state with high-income tax

- combined state and federal tax rate of 40% on income

- capital gains rate of 20%

After five years, the after-tax value of the taxable account is $548,000 and the IRA's after-tax value grows to $541,000 — a total of $1,089,000.

But now look at what happens when you apply a little strategic tax planning by employing a strategy to optimize the location of your investments to minimize taxes.

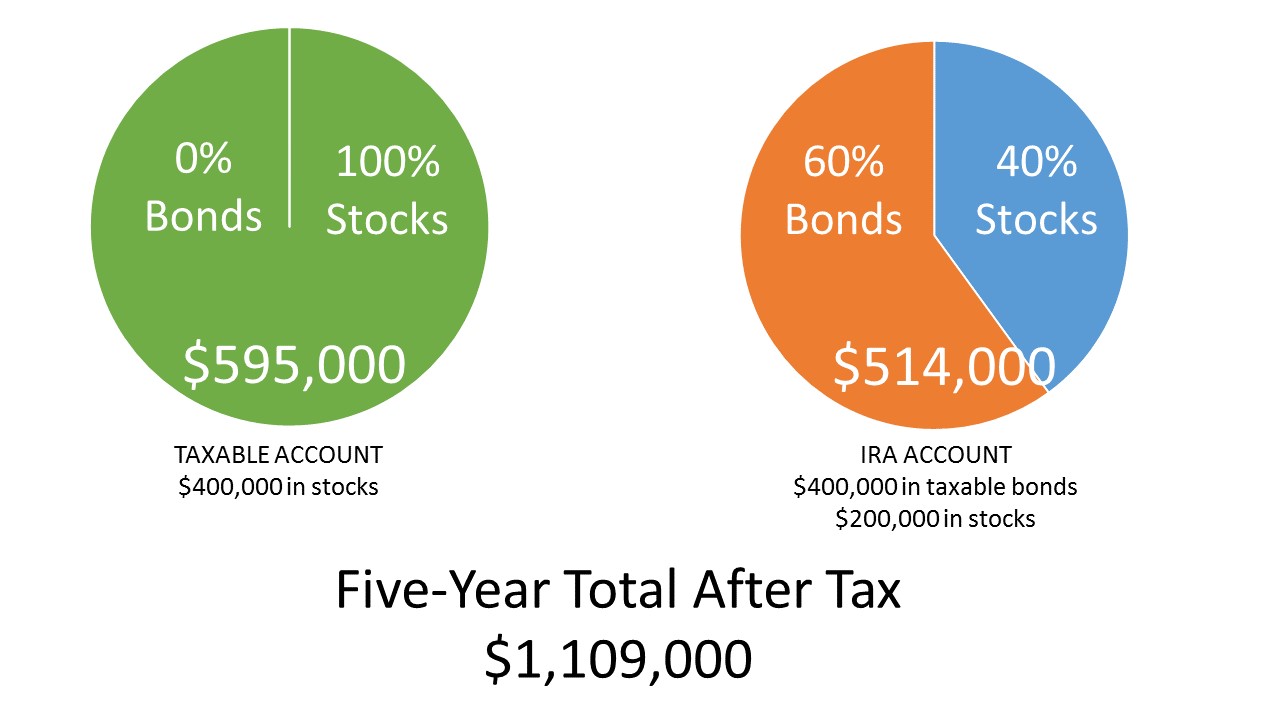

Optimizing for location would place all $400,000 in the taxable account in stocks to benefit as much as possible from the 20% favorable capital gains rate. Why settle for income from the muni bonds of 3.6%, when the after tax-return on stocks annually over the long run has averaged 8%. Meanwhile, optimizing the $600,000 IRAs would mean holding $400,000 in bonds and $200,000 in stocks. Instead of a 60% stock and 40% bond allocation, the IRA would hold the reverse — 40% in stocks and 60% in bonds.

The bottom-line: $1,109,000 expected value on the total portfolio after five years versus $1,089,000. Getting an extra 2% — $20,000 — over five years on a $1 million portfolio may seem insignificant, but it compounds without being taxed every year in the IRA. After 10 or 20 years, the tax-advantaged compounding becomes so powerful it prompted Albert Einstein to say "Compound interest is the eighth wonder of the world."

Because of the long-term nature of this strategy, getting started on the right course soon is wise. If you have questions about tax optimization, please contact us.

© 2024 Advisor Products Inc. All Rights Reserved.

More articles

- 10 Steps To Take On The Path To Early Retirement

- Age Is More Than Just A Number In Weighted Plan

- 8 Compelling Tax Reasons For Roth IRA Conversion

- Steer Clear Of These 7 Traps For IRA Owners

- Seeking Financial Aid: Don't Fear The FAFSA

- Make Sure That You Comply With All The RMD Rules

- Here Are 6 Common Roth IRA Mistakes To Avoid

- How To REALLY Get Ready For Your Retirement Years

- Here's What You Can't Do In An IRA

- Should You Roll Over Or Play Dead? 7 Factors

- Don't Be Caught In The Web Of This Stealth Tax

- Here Are The Latest Tax Traps, Tips, And Tricks

- 6 Common Estate Planning Myths: Here's The Reality

- What Should You Do If An Employee Asks For A Loan?

- How Will Your Retirement Distributions Be Taxed?

More

|

|

||

|